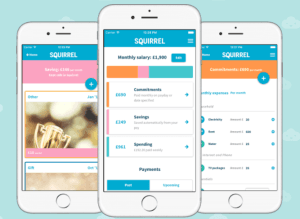

We came across a new app called Squirrel this week that helps you budget to save for the things you really want.

Squirrel is very hands on with your monthly budget in that it acts like a secondary bank account and only releases your wage on a weekly basis. It shows you what you can spend that week and won’t let you overspend so by the end of the month you’re not dipping into your savings.

How does it work?

It does take a little work from you to set it up. You’ll need to sit down and tap in your monthly expenses and saving goals, but once that’s done it is quite easy to use. Once these are set the app then pays out what you need for your monthly expenses into your usual bank account and keeps the rest.

The downside?

Of course, if your savings are in another place you will not earn interest on them, however with interest rates as low as they are at the moment we aren’t earning very much on them anyway! That said, you could also squirrel your money away in an ISA.

The upside?

It’s only £3.99 a month and it is a really easy way to work out your outgoings. If there is an emergency and you need that money you put aside they will send it to you the next day.

For more detail on Squirrel click here!

Disclaimer

We’re not a financial adviser – this news post is not to advertise a service we have any financial interest in, we just like to show our customers what’s new and noteworthy! If you would like to speak to a financial advisor we can recommend one. A financial advisor will be able to discuss your ability to buy a home in detail. If you would like to be put in touch please let one of our Sales Advisors know.